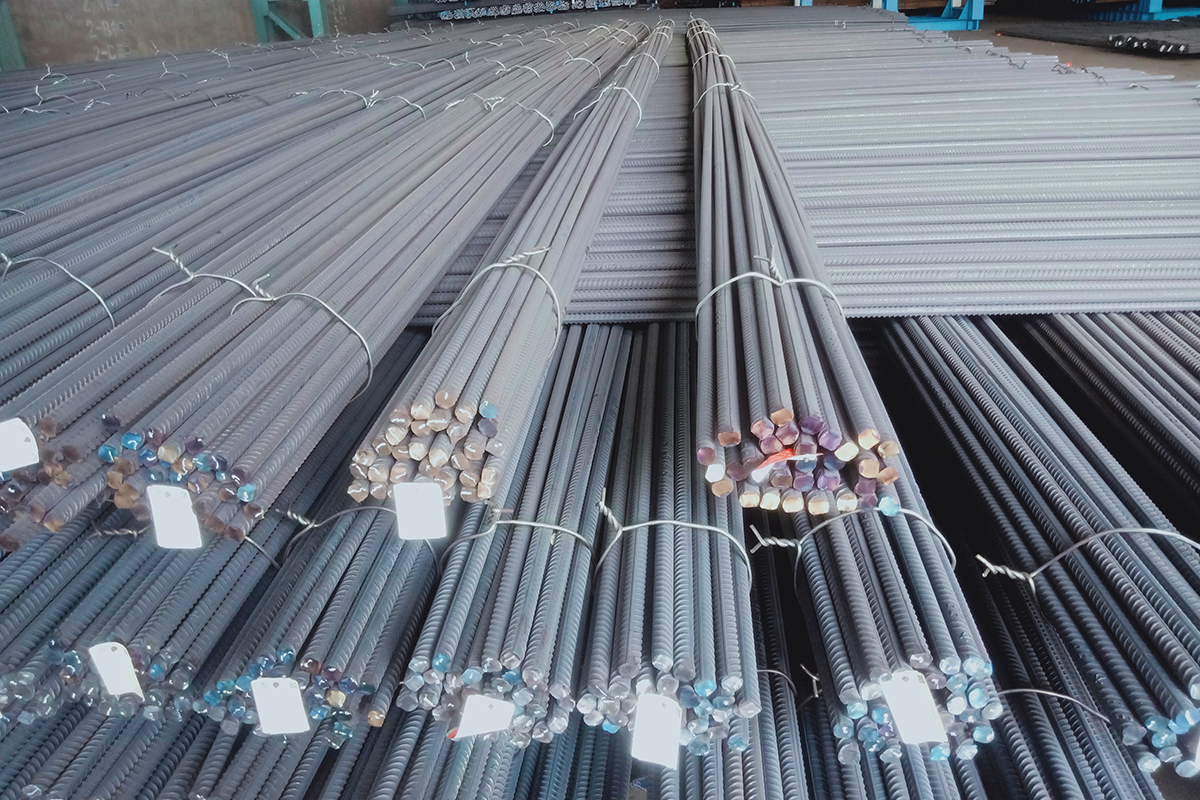

The entry of Korean rebar into the Singapore market marks a significant development in the steel trade. This move comes as South Korea, a major steel producer, faces a weak domestic construction market. Rebar, especially in the ASEAN region, is showing a decline in import prices, and traders are focusing on spot-based transactions. For the first time, a South Korean steel mill, after receiving CARES certification last year, began offering theoretical-weight rebar at $485/tonne cfr Singapore for shipments scheduled in February and March. This is a clear indication of South Korea’s strategy to expand its long steel exports due to the weakening local demand.

The global rebar market has seen a drop in prices across regions. In Singapore, import prices for rebar are softening, with theoretical-weight offers as low as $480/tonne cfr for shipment by July. The price drop has affected various regions, including Malaysia and Hong Kong, where rebar prices are fluctuating between $485-490/tonne and $490-495/tonne, respectively. As the construction market in Korea continues to struggle, this has led to an oversupply of steel, prompting producers to look for markets where demand is more stable, like ASEAN.

In addition to the price decrease, the weak South Korean won, caused by the ongoing political crisis, provides an added advantage for exporters. The currency depreciation further makes Korean products more attractive in international markets. Traders anticipate that with continued weak domestic demand and favorable exchange rates, South Korean steel mills will focus on ASEAN markets for exports, primarily through spot deals, which offers flexibility and quick turnover.

As part of the broader trend, ASEAN’s wire rod and rebar market, particularly in Manila and Thailand, is also seeing price reductions. The Chinese rebar and wire rod offerings have shown similar price declines, with reports indicating a 2.5-dollar drop in wire rod prices. Despite the low pricing, traders are still awaiting bookings, indicating that while prices are dropping, market activity remains relatively quiet after the holiday period.

In conclusion, the entry of Korean rebar into the Singapore market highlights the shifting dynamics in the steel industry, driven by domestic demand challenges and currency fluctuations. South Korea’s proactive approach to boost exports, despite domestic challenges, signals a strategic response to global market trends. As ASEAN remains a key market for rebar exports, the competitive pricing strategies employed by Korean producers are expected to influence the steel trade in the region throughout the year.