The Vietnamese hot rolled coil (HRC) market remained subdued last week, with limited buying interest, reports Kallanish. Market participants are bracing for a pending trade case that could result in anti-dumping duties on HRC imports from China and India. The investigation is expected to conclude by year-end or early 2025, with the possibility of retroactive duties.

Vietnamese buyers have been stocking up ahead of the anticipated tariffs. Normally, they maintain 1.5-2 months of inventory, but over the past two months, purchases have increased to 3-4 months of supply, according to a trader in Hanoi.

Chinese HRC Arrivals and Demand

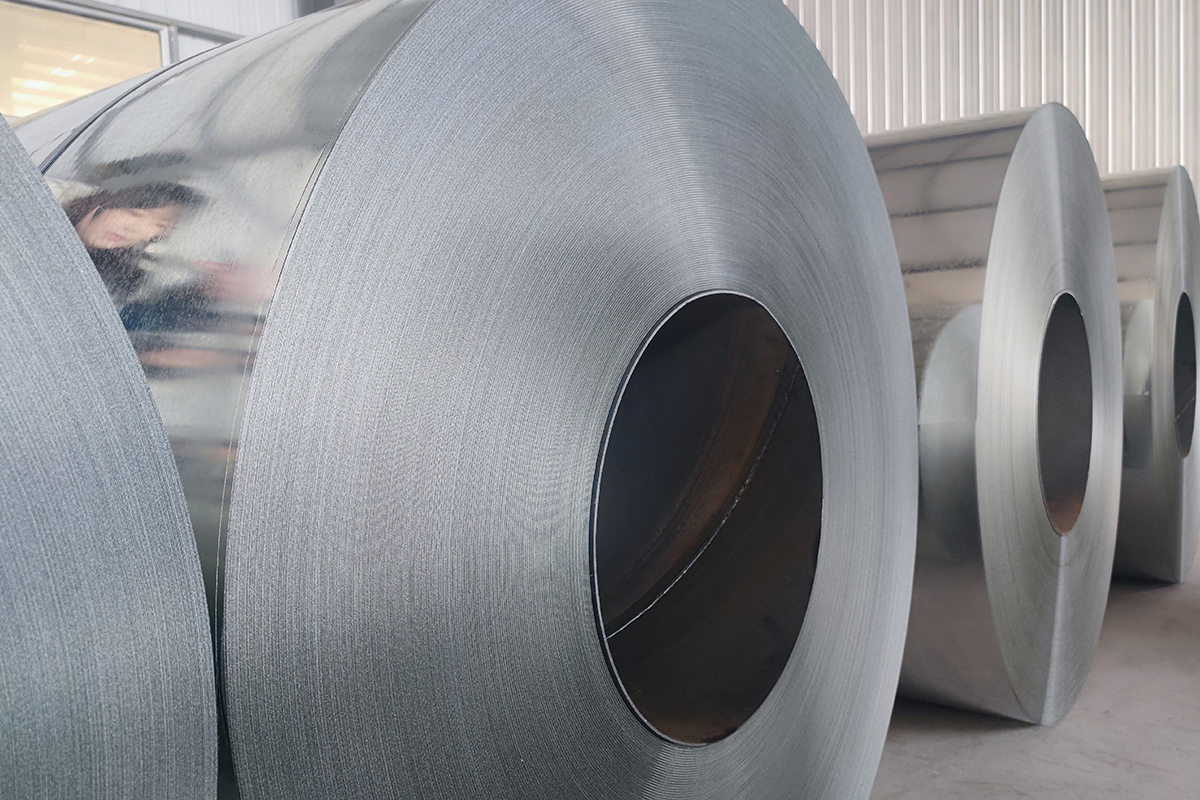

Limited quantities of wider-width Chinese HRC have begun arriving in Vietnam. Service centers are primarily purchasing 2,000mm-width coils in Q235 and Q345 grades for structural applications. These centers are also investing in new facilities to handle wider coils and are installing slitting machines imported from China. The estimated slitting cost is VND 150-300/kg ($6-12/t).

Chinese 3-12mm Q235 2,000mm-width HRC was offered last Friday at $500-504/t cfr, though bids from some customers were as low as $495/t cfr, reflecting cautious sentiment. Rerolling-grade SAE1006 HRC (2mm and above) was offered at $510/t cfr, while stock lots for prompt December shipment were priced at $500-505/t cfr.

Other Regional Offers

Japanese and South Korean SAE1006 HRC were offered at $530-540/t cfr Vietnam, while Taiwan’s offer was at $540/t cfr. Prices for SAE-grade HRC in 2-2.7mm thickness increased by $5 week-on-week to $510-520/t cfr.

As the market awaits the results of the trade case and prepares for potential duties, buying strategies and inventory adjustments remain the focus for Vietnamese market participants.